It is common to have questions when it comes to finance. We have compiled the answers to those we are asked the most. If your question is not included below, please fill out an enquiry form here.

If you have had a good experience with AA Money then we’d love for you to let us know. We also want to improve our service so if for some reason we didn’t meet your expectations please let us know so we can improve things in the future. As always, if you want to talk to someone, give our friendly customer services team a call on 0800 600 777 or send us an email.

Frequently Asked Questions

How can I apply?

You can apply via our online application or by calling 0800 500 555.

Who can apply for an AA Money loan?

You can apply for an AA Money loan if you are at least 18 years of age

You must also be a New Zealand citizen or permanent resident and hold a valid form of New Zealand identification. We will request a valid restricted or full driver’s licence if the vehicle you are purchasing requires it. Submitting an application does not constitute a quotation or offer of finance by AA Money.

The minimum loan amount is $5,000.

What are your fees and charges?

The fees and charges for AA Money loans are available here.

What are the terms and conditions?

For a copy of our terms and conditions, please see AA Money Terms & Conditions.

These include but are not limited to the following:

- normal lending criteria will apply

- your vehicle will be required as security and it must be fully insured

- AA Money will agree a loan term from 1-5 years

What are your interest rates?

AA Money’s standard annual interest rates start from 11.20%. The rate you are charged will take into account a number of factors, including:

- the size of your deposit

- how much you want to borrow

- the term of your loan

Want to know what interest rate you are eligible for? We need to understand a little more about you and your circumstances so please fill out an application form and we will get back to you. If you have any further questions regarding interest rates, please contact us.

What information do I need to supply?

After completing the application with your personal and financial information we will ask you to provide evidence of your identity, address, income and expenses to help us assess the suitability and affordability of the loan. We will need:

• A copy of both sides of your driver licence.

• The name of the insurance company the vehicle will be insured with.

• Proof of income for all income sources for each borrower and each guarantor.

• If you are paid a salary or wages, we will accept bank statements or payslips dated within the last 6 weeks.

• If you are self-employed, we will need a recent IRD personal tax summary (PTS).

• For each borrower and each guarantor, we will need 90 days of bank statements or suitable invoices to confirm expenses.

What security do I need to provide?

Generally the car being purchased, is used as security for the loan. We may also ask for a guarantor.

Do I need a deposit?

Depending on your circumstances we may be able to fund up to 100% of your planned purchase. However, all loans will be subject to both lending criteria and responsible lending inquiries being made.

How long will it take for a lending decision to be made?

We aim to have a decision within a day, sometimes sooner, but before we make a decision, we must make our responsible lending checks which include assessing the suitability and affordability of the loan you have applied for.

I have an existing loan, can I switch to AA Money?

Yes, as long as your application satisfies all of our normal lending criteria. Standard fees will apply.

What should I do if my contact details change?

It is important that your contact information is kept up to date so if your contact details change please let us know. Give us a call on 0800 600 777 or email us at [email protected]

What happens if I change my mind and don’t want to proceed with the loan?

You have between 5 and 9 business days from receiving your finalised contract to notify us that you wish to cancel. See the front of your loan contract to work out which time period applies to you.

If you wish to cancel, please contact us on [email protected] or call our friendly team at 0800 600 777.

I've had a change in my personal circumstances which means I'm struggling to make my loan payments, what should I do?

We know that unexpected things can happen in life and you might not be financially prepared to cope. For example, losing your job or getting sick may cause you to struggle with your loan repayments.

If you find yourself in a situation like this, we encourage you to talk to us about how your change in circumstances is impacting your financial position – we might be able to offer you some assistance to help you deal with the financial difficulties you’re facing. If you wish to apply for assistance or have any questions, please contact us on 0800 600 777.

What happens if I miss a payment or can't make a payment on time?

When you sign your contract, you agree to make repayments in line with the payment schedule.

We appreciate that things may happen that affect your ability to make these payments as planned, however if you fail to make these payments on time or fail to pay you may incur additional costs and default interest. Our fees and charges are set out here. If you continue to miss payments, we may report a default to a credit reporting agency which may impact your ability to borrow in the future. If the situation is not resolved, we may look to repossess and sell the vehicle held as security under the loan. If the sale of the vehicle does not cover your outstanding debt you will remain liable for the shortfall.

In the first instance we would like to help you work out a solution so please call us on 0800 600 777 or email us at [email protected]

Can I get a loan approved before I have found the car that I want? And how long does it last for?

Yes, you can get a pre-approval. This is a great way of knowing what you can afford and being a cash buyer can help you negotiate a good deal on your new vehicle. The pre-approval period is 30 days.

Can I buy a vehicle privately?

Yes, and we can finance vehicles purchased through actions such as TradeMe.

Why do you need to see my bank statements?

The government has made some changes to how money is lent to consumers in New Zealand to help protect you against unaffordable debt. This means we need to collect extra information from you and check the information is correct. We need to see at least 90 days’ worth of your bank statements to verify your income and expenses and to assess whether you can afford the loan that you have applied for. We have partnered with Bud to help you provide us this information in a simple and secure way.

Who is Bud and what will they do with my bank statements?

Bud is a third party entity that we have partnered with to help you provide us your bank statements in a simple and secure way. When you upload your statements to Bud, they collate the transaction details from your statements and categorise your transactions into ‘buckets’ (e.g. rent, utilities, groceries etc.) before sending this information to us so that we can assess and verify your income and expenses. You can find more information and guides on how to use Bud here.

What to do if I'm having concerns about my finances?

If you are having concerns about your finance, you can get free and confidential advice from an independent service, MoneyTalks, which is funded by the Ministry of Social Development. You can contact MoneyTalks via:

Freephone: 0800 345 123

Text: 4029

Email: [email protected]

Online chat/website: http://www.moneytalks.co.nz

You can also find out more information about Building Financial Capability Services on the Ministry of Social Development website.

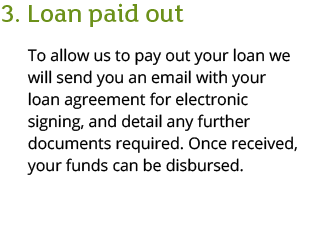

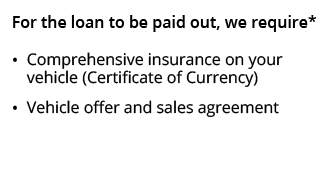

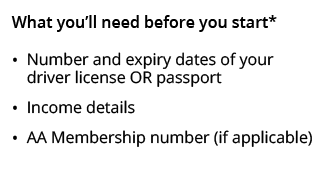

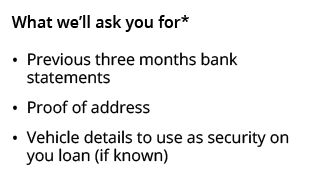

What you will need to apply for a loan

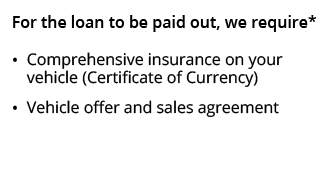

*Depending on the nature of your application and your unique circumstances, this list may not include all of the information we might require from you to make the final decision on your loan application. Normal lending criteria, terms, conditions, and fees apply.

What you will need to apply for a loan

*Depending on the nature of your application and your unique circumstances, this list may not include all of the information we might require from you to make the final decision on your loan application. Normal lending criteria, terms, conditions, and fees apply.

We use APLYiD to verify your identity and your identification documents. With APLYiD this process can be completed online in under 5 minutes. All you need to complete these checks are your mobile phone and a valid form of ID (New Zealand Passport or New Zealand Drivers licence). If you do not have these documents we can manually verify your identity through other methods.

You will receive an SMS containing a link to complete our identity checks through APLYiD, on the phone number you supply as part of your application.

APLYiD’s Privacy Policy is available on its website https://www.aplyid.com/.

Got some feedback for us?

If you have any concerns about this agreement, please let us know. You can contact us by email, phone or post:

0800 600 777

AA Money, provided by UDC Finance Limited

PO Box 91145

Victoria Street West

Auckland 1142

If you don’t think we’ve resolved your concerns after contacting us, you can seek help from and make a complaint to Financial Services Complaints Limited. This scheme can help you resolve any disagreements you have with us. You can contact Financial Services Complaints Limited by email, phone or post:

0800 347 257

FSCL

PO Box 5967

Wellington 6140